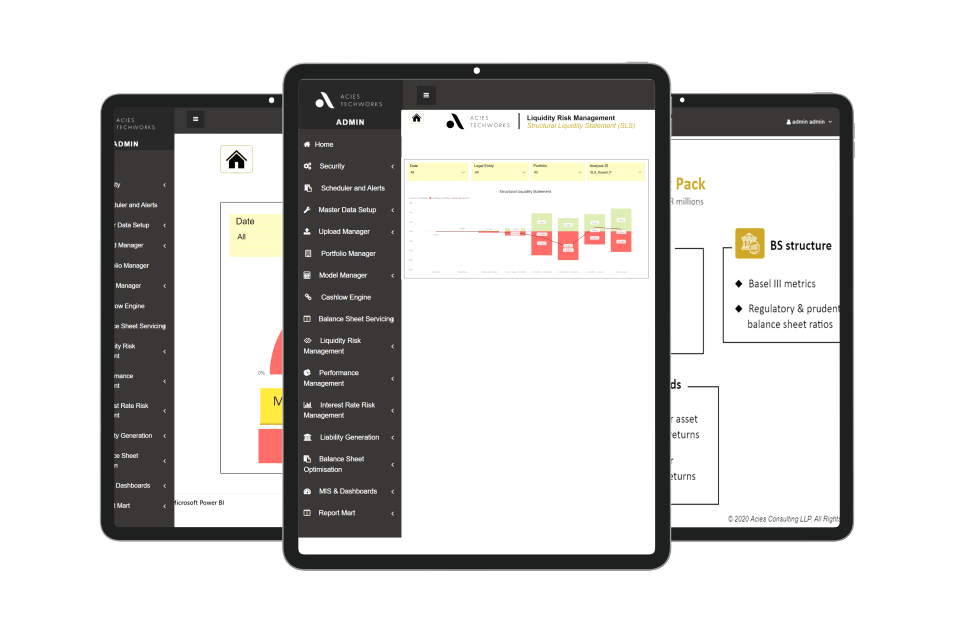

Antares ALM

Enhance liquidity and interest rate risk management through real-time monitoring, regulatory compliance, and advanced decision support tools

Enhance liquidity and interest rate risk management through real-time monitoring, regulatory compliance, and advanced decision support tools

Simplify comprehensive balance sheet management with customizable compliance reporting, robust data management, and unparalleled flexibility and speed. Stay ahead of regulatory guidelines and drive superior business outcomes with hassle-free reporting, data integration, and risk quantification.

Access pre-built cashflow models for optimized performance across 100+ financial instruments, including credit disbursement, trade finance, treasury, and hedging.

Utilize modeling for behavioral adjustments to refresh and improve cashflow projections based on recent data and external behavioral studies.

Benefit from cashflow models for all financial instruments and behavioral models for non-maturity deposits and embedded optionality.

Leverage pre-configured model repositories and multi-scenario analysis for better decision making, including behavioral models for loan prepayment, early term deposit redemption, and NMDs. Track and analyze cashflow and behavioral trends through a historic data repository.

Enables configuration of cashflows for identifying gaps and mismatches across multiple currencies.

Built-in limit monitoring with alerts and notifications for limit breaches for proactive risk management.

Allows for simulations to evaluate the impact of new positions and portfolios on liquidity profiles and gaps, providing informed decision making.

Built-in early warning indicators and liquidity risk stress testing linked to contingency funding plans for proactive liquidity risk mitigation.

Offers pre-built tools to generate Basel III LCR, NSFR, and Leverage Ratio in accordance with BCBS methodologies for accurate and reliable calculations.

Comprehensive monitoring of liquidity health based on funding ability, liability mix, and liquidity pool to ensure adequate coverage of liquidity risk.

Enables ad-hoc monitoring and reporting of Basel III liquidity ratios and trends for reporting to the ALCO, facilitating informed decision-making.

Provides pre-developed regulatory reporting packs aligned with regulatory requirements for streamlined regulatory compliance.

Comprehensive analysis of interest rate risk by providing users with an IRS (Interest Rate Sensitivity) Repricing Gap Analysis that allows to assess the risk of changes in interest rates on their balance sheet by analyzing the difference between interest rate sensitive assets and liabilities that reprice within a given time period.

Offers interest rate scenarios for Net Interest Income (NII) and Economic Value of Equity (EVE) impact analysis that allows users to evaluate the impact of different interest rate scenarios on their NII and EVE metrics.

Provides intelligent optimization algorithms to derive ideal liability portfolios and calculate the cost of funds that enables users to optimize their balance sheet and assess the instantaneous impact on their Net Interest Margin (NIM).

In-built rule engine and workflow management that can be used across all modules seamlessly

Front-end user configurable custom models, analytics and dashboards

Industry tested and ready to use models, MISes, dashboards and regulatory reports

Micro-services architecture enables deployment of specific modules to the existing platform without disrupting data relations and functionalities