Model Governance

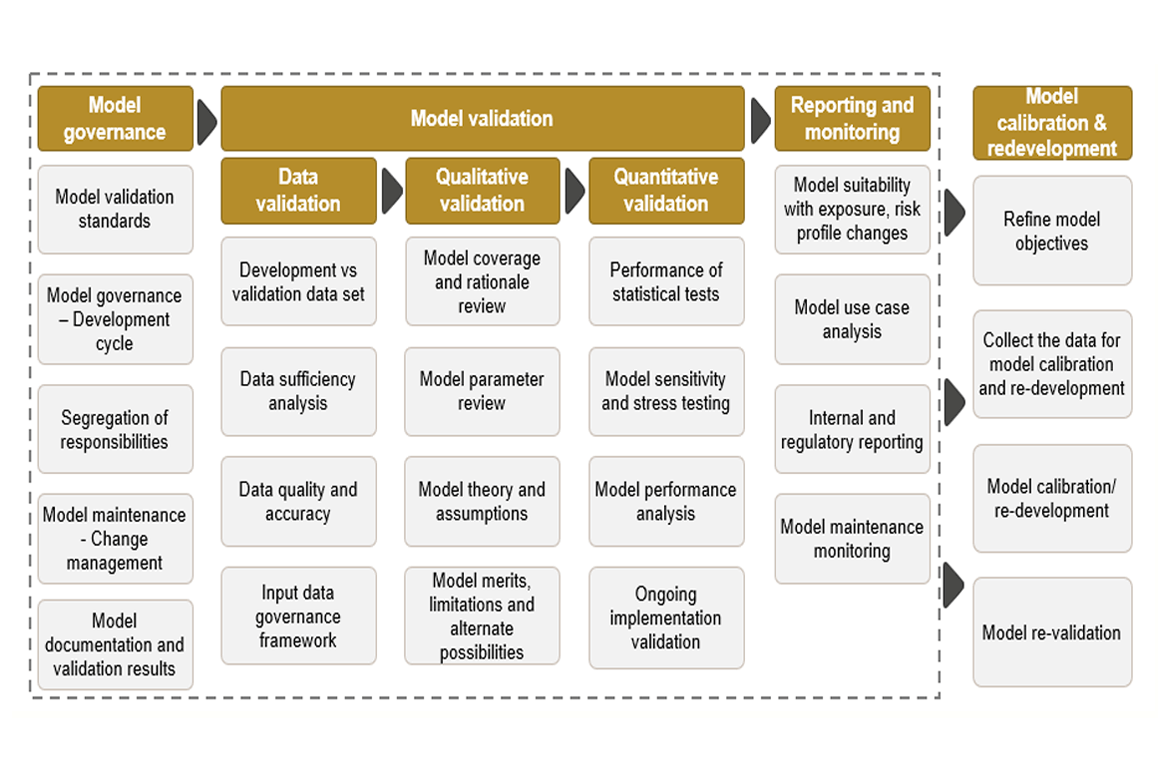

Adherence to model risk policy, validation standards and change management protocols

Adherence to model risk policy, validation standards and change management protocols

Alignment of model objectives with statistical basis, variable set identification and parameter calibration

Estimating model health score, defining early warning indicators for model risk, model contingency planning and model risk reporting

Qualitative and quantitative validation along with data suitability analysis and validation

Kepler MRM's model risk management framework is aligned to regulatory requirements and industry standards, including the Federal Reserve's SR 11-7, EU's TRIM and Basel guidelines.

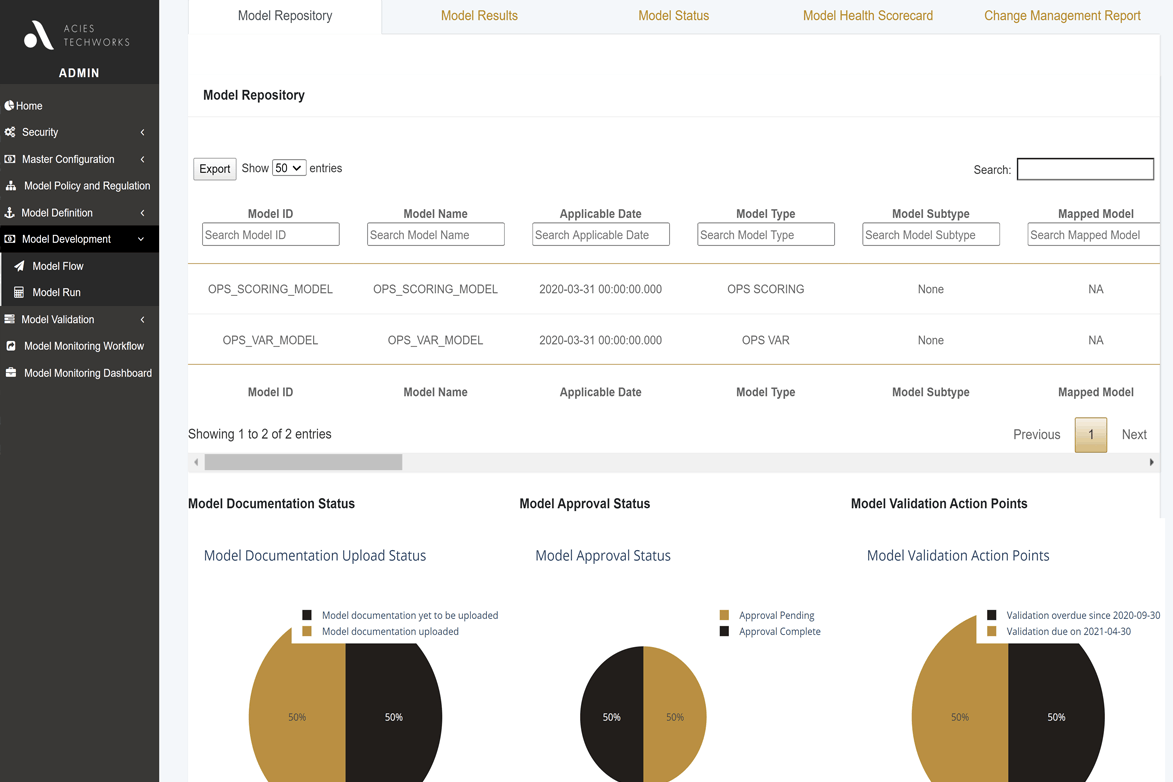

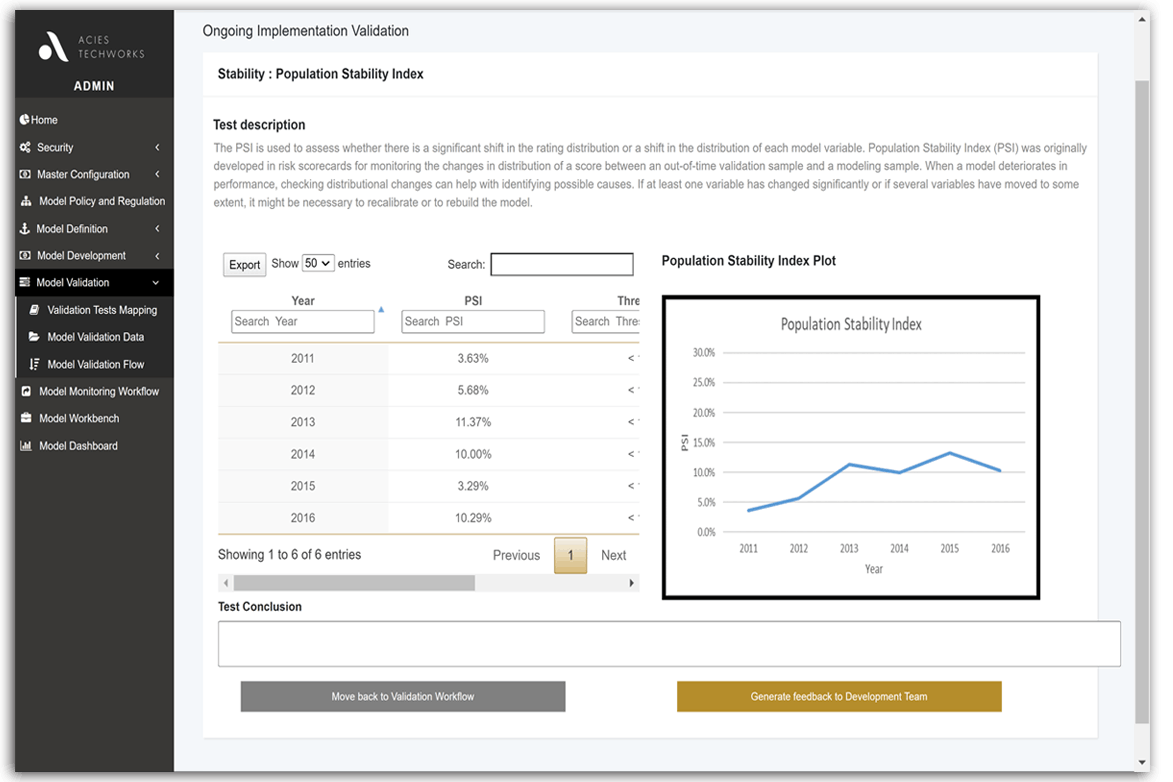

A large repository of workflows, dynamic checklists, statistical validation tests with computations and performance measures to use or to further customize to your requirements

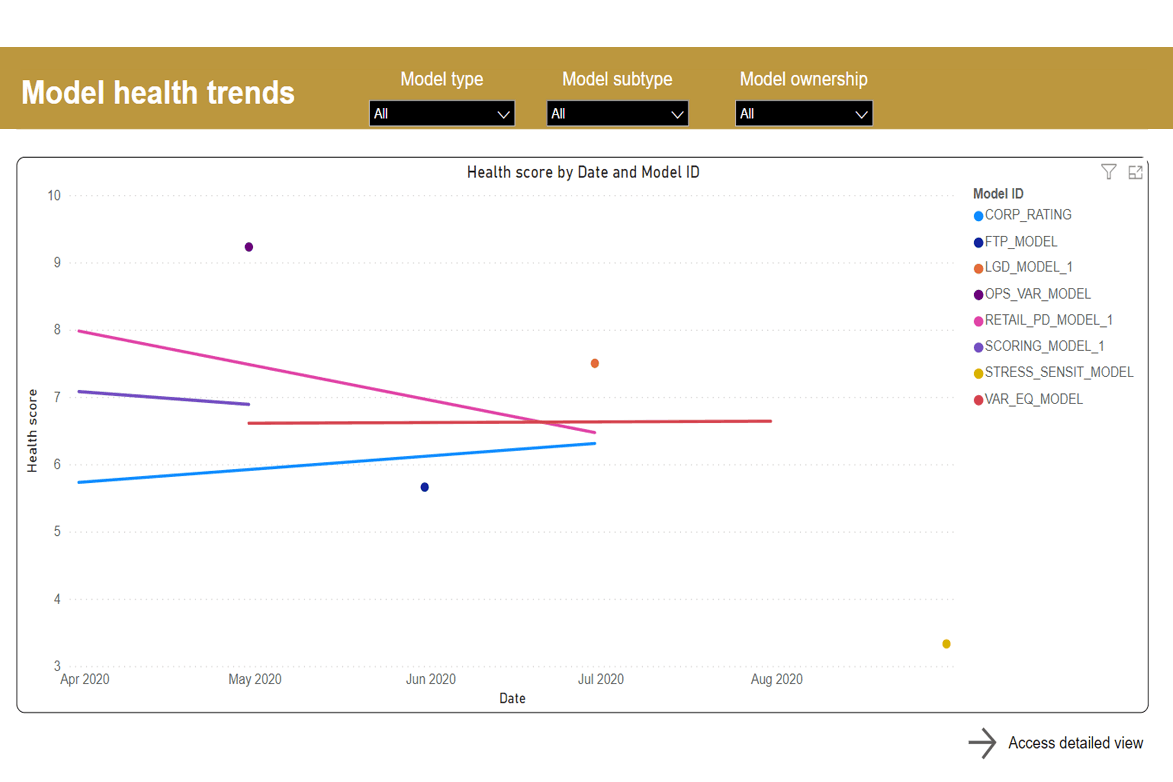

Model health score and pending actions across all models available at the click of a button with the ability to trigger workflows, alerts and reports

Host challenger models for benchmarking model performance from a extensive library of pre-built models