Antares CM

Simplify and optimize risk-based capital management while ensuring regulatory compliance

Simplify and optimize risk-based capital management while ensuring regulatory compliance

Standardized approach (Basel II and Basel III compliant) and extendable to Basel IV

SMM approach computations of sensitivity factors (PV01, Duration) and valuations

Choice of BI, standardized approach and revised standardized approach

Computation of Tier 1 and Tier 2 capital, ensuring accurate deductions and eligibility checks.

Real time CRAR computation and monitoring with triggers for any breach

Pillar III disclosures related to capital computations and internal MIS/ dashboards

Configurable scenario analysis and stress testing for capital management

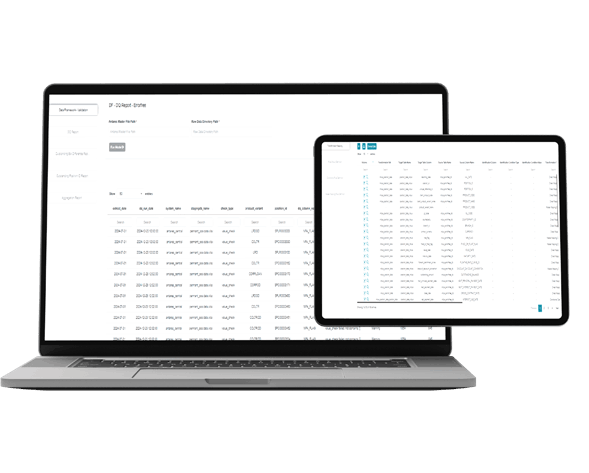

Risk-Weighted Asset Precision Modelling

Market Risk Sensitivity Coverage

Dynamic Operational Risk Computation

Multi-Dimensional Data Integration

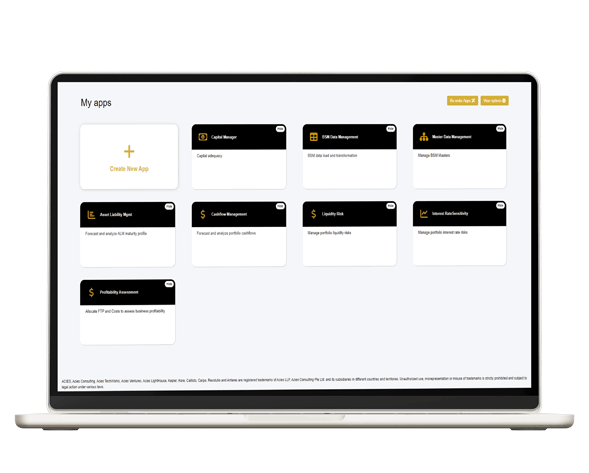

Customizable No-Code Modelling Studio

Extendable Ecosystem

Pre-configured functionalities enable deployment within 4-6 months for faster ROI.

Microservices-based architecture supports on-premise, cloud, or hybrid deployments with high resilience.

Containerized design ensures flexibility and seamless scaling as organizational demands grow.

Implements robust encryption for data at rest and in transit to ensure complete security

Ensures compliance with stringent regulatory standards for data management and user activity monitoring

Provides detailed audit trails, role-based access controls, and predefined governance policies

In-built rule engine and workflow management that can be used across all modules seamlessly

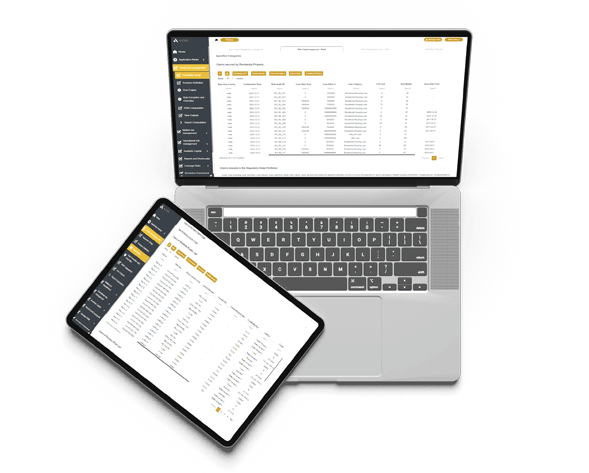

Front-end user configurable custom models, analytics and dashboards

Industry tested and ready to use models, MISes, dashboards and regulatory reports

Micro-services architecture enables deployment of specific modules to the existing platform without disrupting data relations and functionalities