Planning and performance management

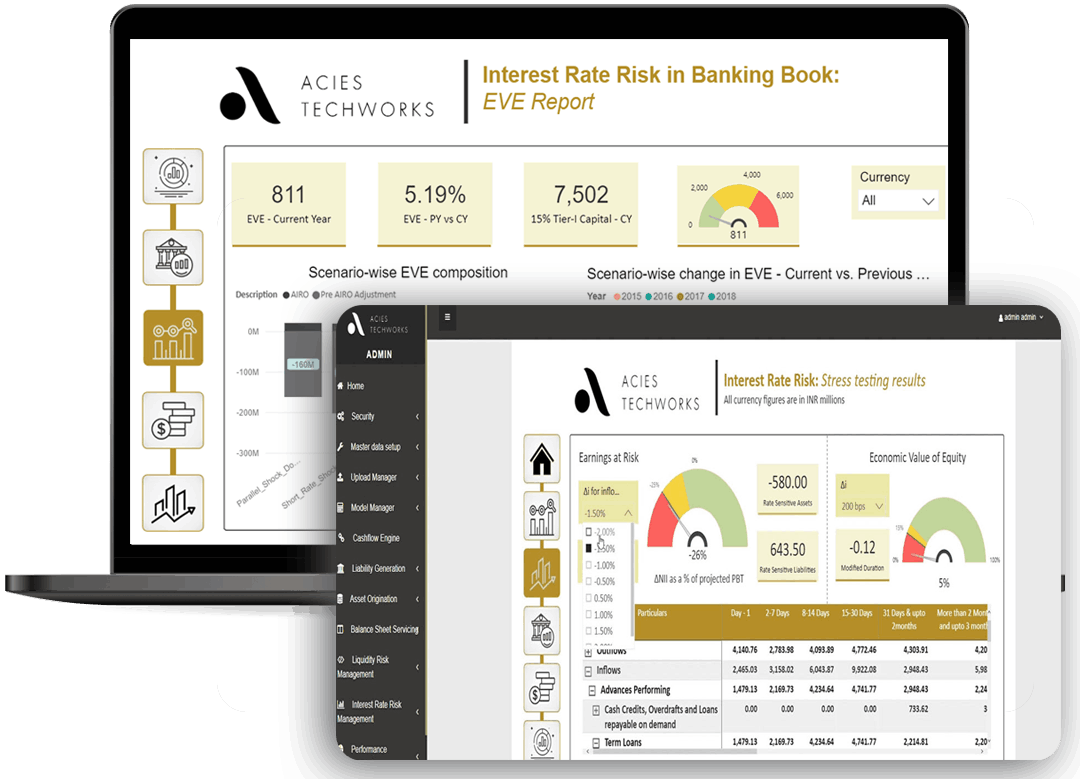

Multi-year budgeting and planning across run-off and projected financials with scenarios to assess impact of on profitability and ROE

Dissect revenue and cost drivers across data hierarchies to determine customer, product and business unit earnings, financials and return metrics

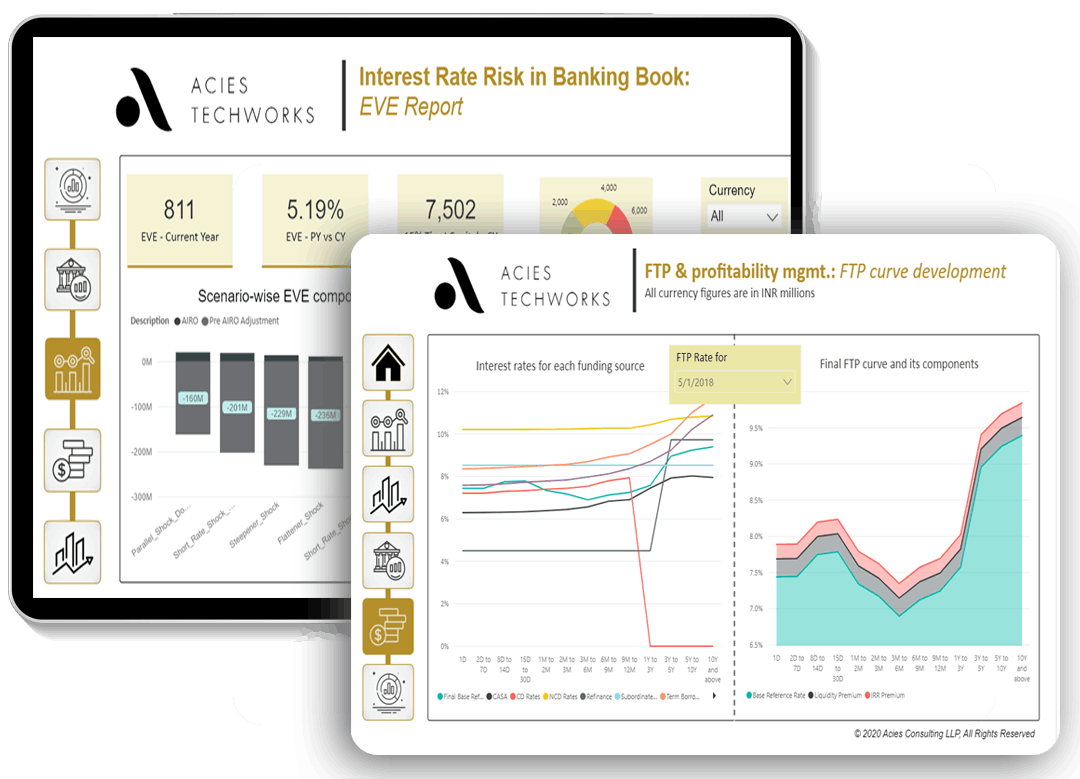

Out-of-the-box support for multiple fund transfer pricing methodologies including use of market linked benchmarks

Factor-based models for allocation of non-interest revenue and cost to the relevant profit and cost centers

FTP pooling methodologies to dissect balance sheets based on performance units and funding mix strategies