Antares IRRBB

Monitor the interest rate risk impact dynamically across various scenarios in a fully automated environment

Monitor the interest rate risk impact dynamically across various scenarios in a fully automated environment

Classify your products with ease as per regulatory expectations

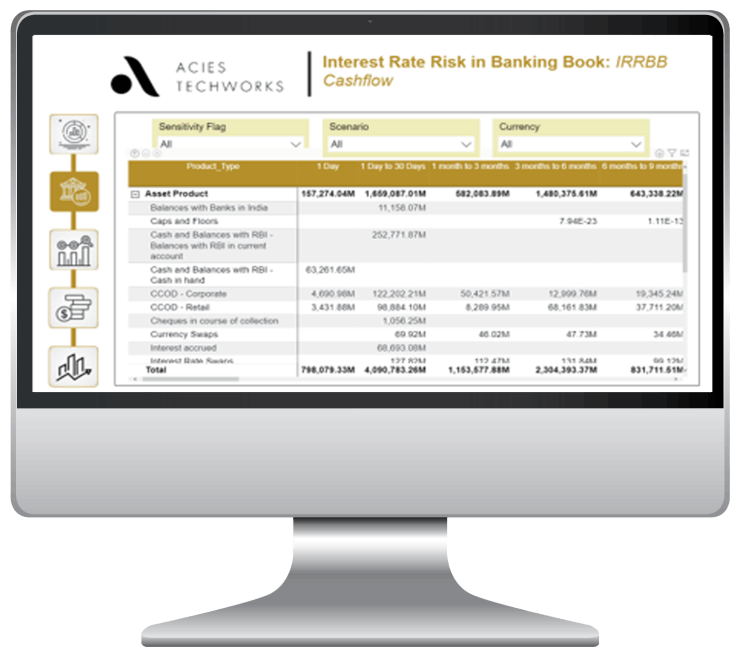

Generate position-level cashflow reports with detailed analytics

Run various scenarios and view cashflows in minutes

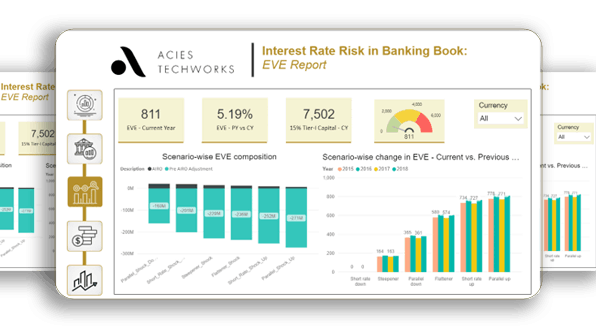

Perform fair value of AIRO and adjustments under different scenarios

Automatically compute and generate EVE statements in a click of a button

Simulate and generate NII reports using different assumptions

In-built rule engine and workflow management that can be used across all modules seamlessly

Front-end user configurable product and model manager, scenarios and parameters, and report formats

Industry tested and ready to use models, MISes, dashboards and regulatory reports

Micro-services architecture enables deployment of other Antares applications to the existing platform without disrupting data relations and functionalities