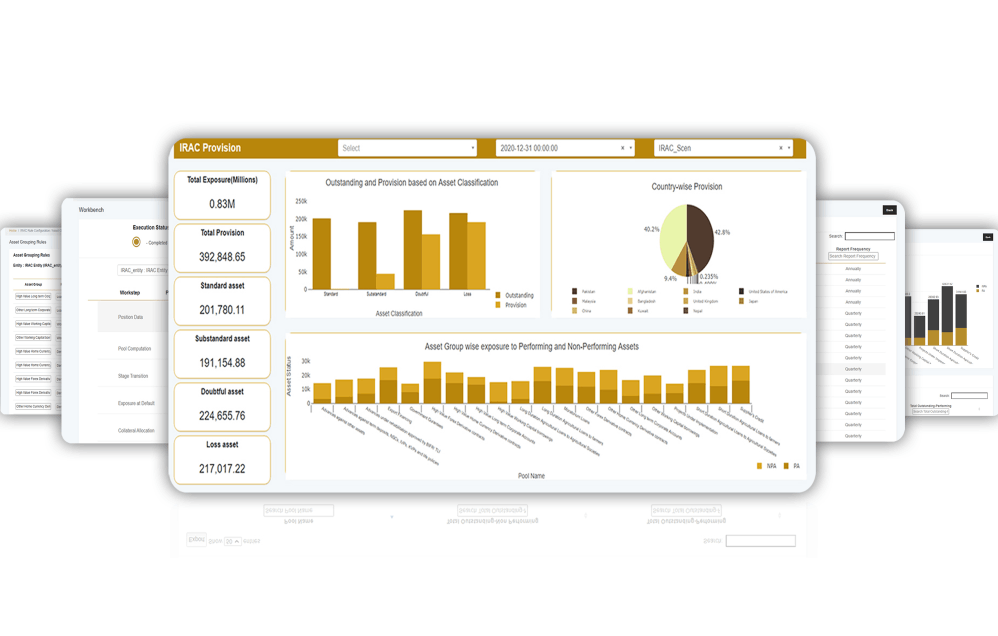

Kepler CPM helps financial institutions manage credit quality, performance and provisioning

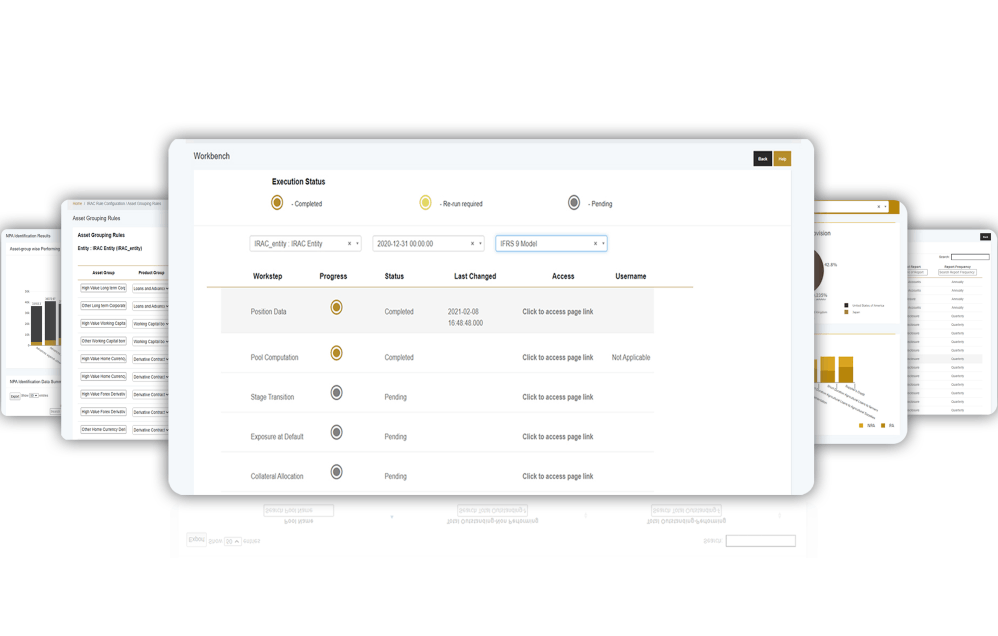

Integrated and real-time

Single view across geographies, entities and portfolios

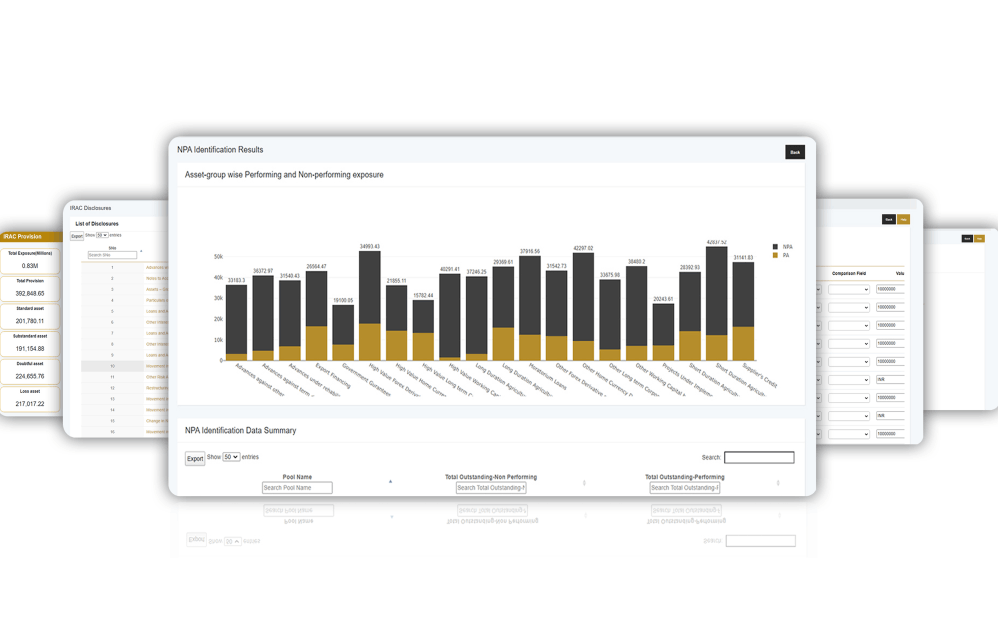

Keep track of movements in credit quality

Drill through to facilities and positions

Evaluate impact on provisioning under future scenarios

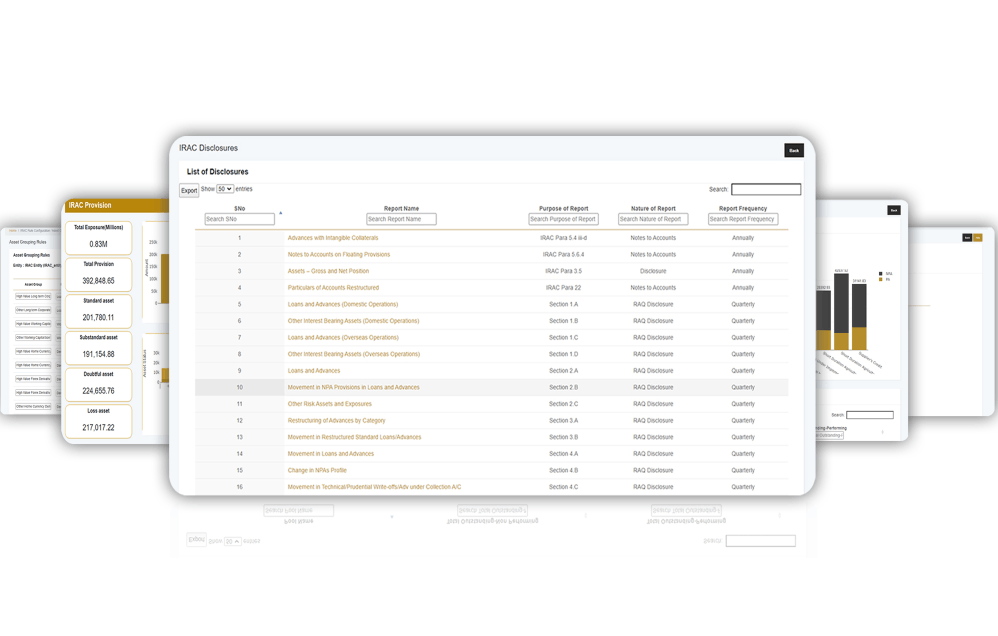

Comply with regulatory classifications and changes at a click of a button

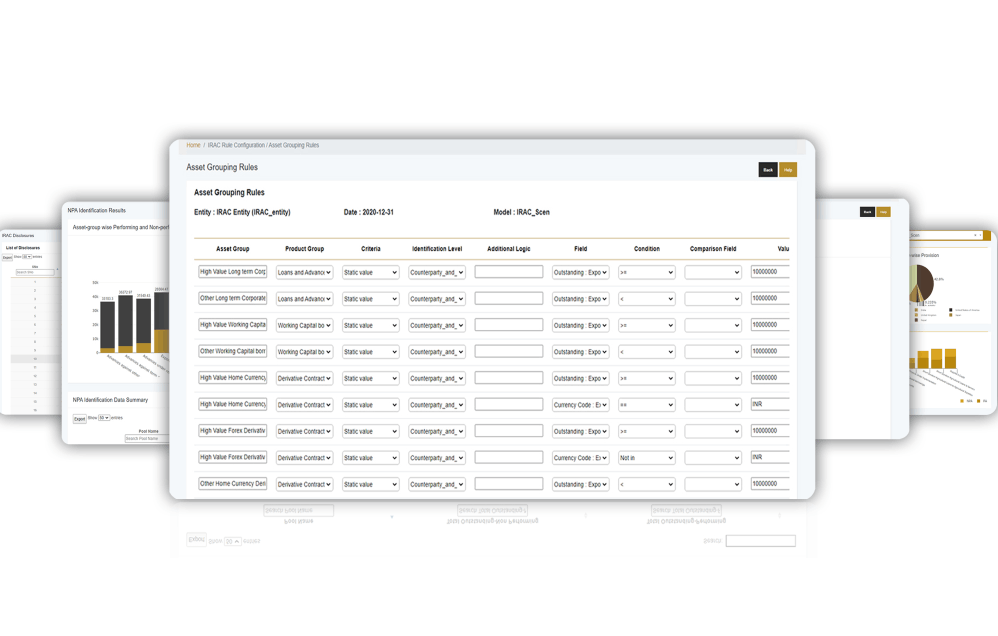

Setup regulatory rules and demonstrate compliance to regulators

Easily change classifications as regulations change

Classification by multiple cuts including products, customers, collateral attributes and guarantee attributes

Run multiple classifications simultaneously

Optimize, assign and compute impact of collateral in provisions

Assign collateral to facilities, borrowers and portfolio groupings

Optimize collateral allocation based on contractual and regulatory constraints

Manage bilateral netting arrangements and their impact on IRAC

Compute ongoing collateral coverage and assess collateral valuation impacts on coverage

Forecast, assess and manage provisioning impact

Seamlessly manage NPA bucketing based on DPD and other rules

Set provisioning ratios based on changing regulatory regimes based on asset grouping, obligor grouping, instrument grouping, guarantee and collateral attributes

Forecast and simulate NPA provisions for changes in regulatory and business scenarios

Proactively identify hot spots in the credit portfolio

Pre-built and up to date financial and regulatory provisions