Kore MR

Empowers intelligent treasury and risk management through real-time monitoring, integrated insights, and regulatory compliance

Empowers intelligent treasury and risk management through real-time monitoring, integrated insights, and regulatory compliance

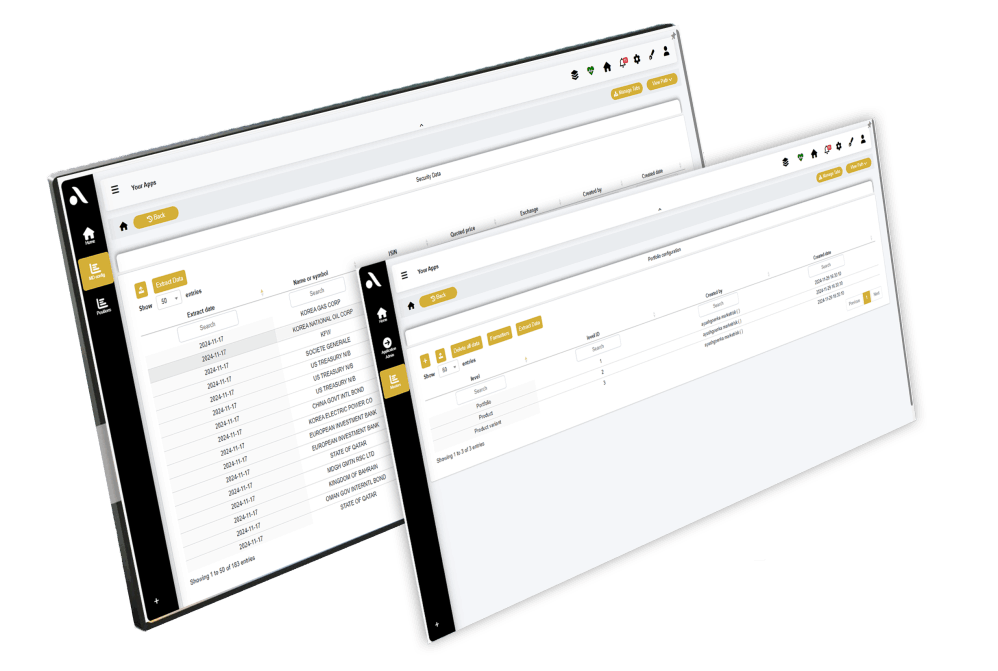

Multi-Asset Class Support

Comprehensive Risk Analytics

Advanced Scenario Management

Integrated Reporting Capabilities

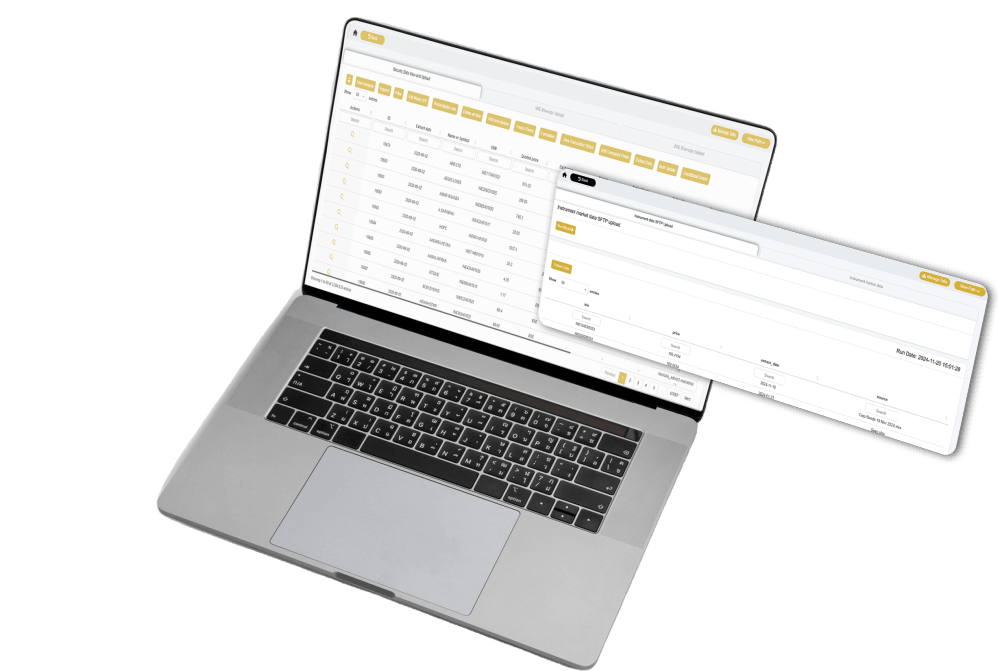

Seamless Data Integration

Regulatory and Internal Reporting

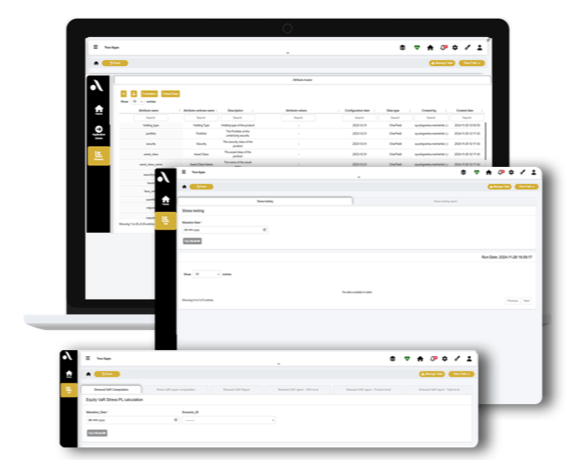

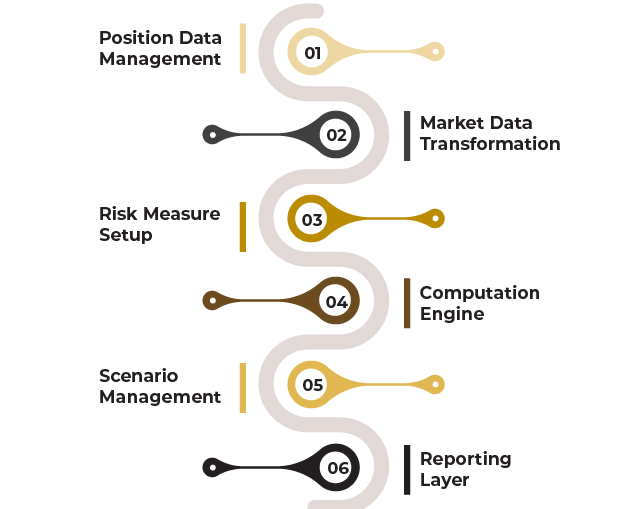

Automates position hierarchy setup, data reconciliation, and risk factor configuration

Includes interpolation, zero curve generation, and proxy handling for seamless analytics

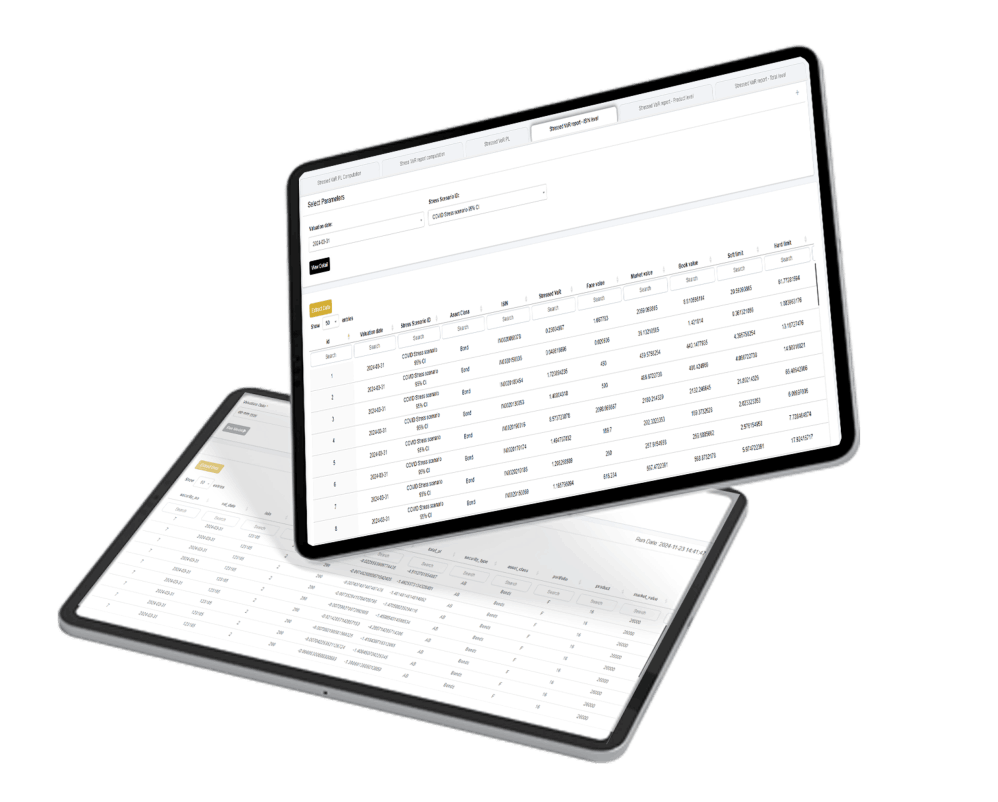

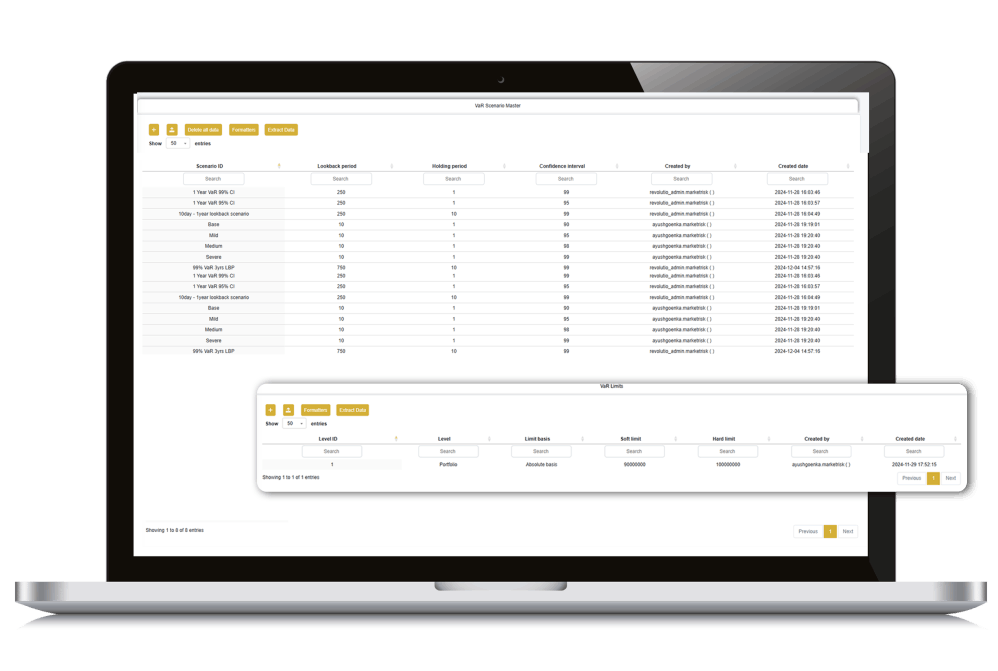

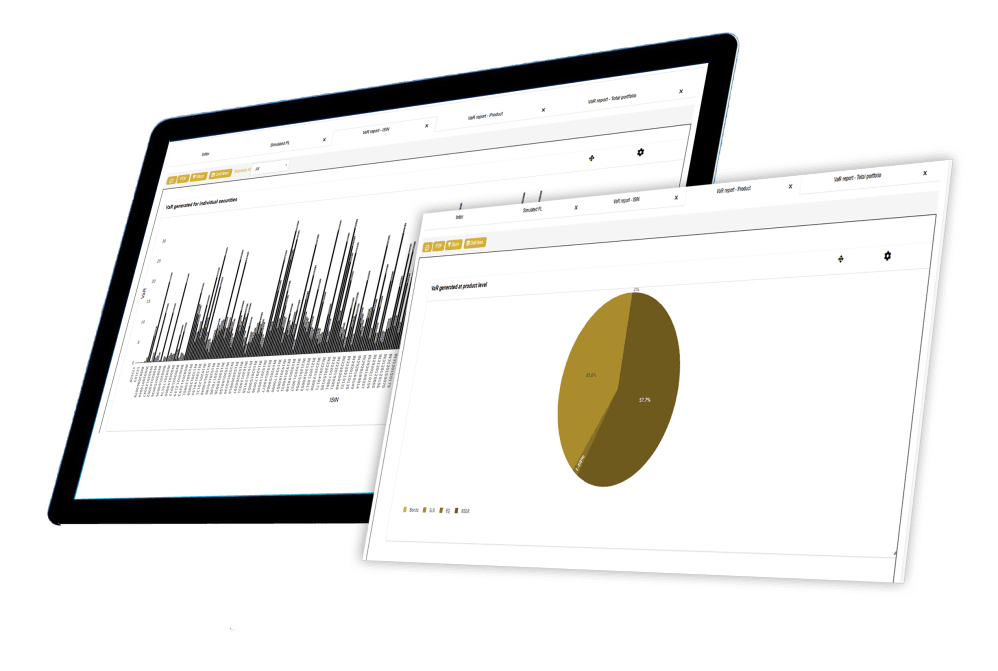

Supports comprehensive metrics such as VaR, S-VaR, and stress testing for accurate financial assessments

Provides cashflow analysis, valuation, simulations, and other statistical measures, offering a unified computation engine adaptable to various use cases

Enables scenario customization and P/L simulation for informed decision-making

Delivers insights via interactive dashboards and customizable reports

Cloud compatibility for seamless integration

Scalable design accommodating diverse client needs

Secure data management practices for regulatory adherence