Accounting

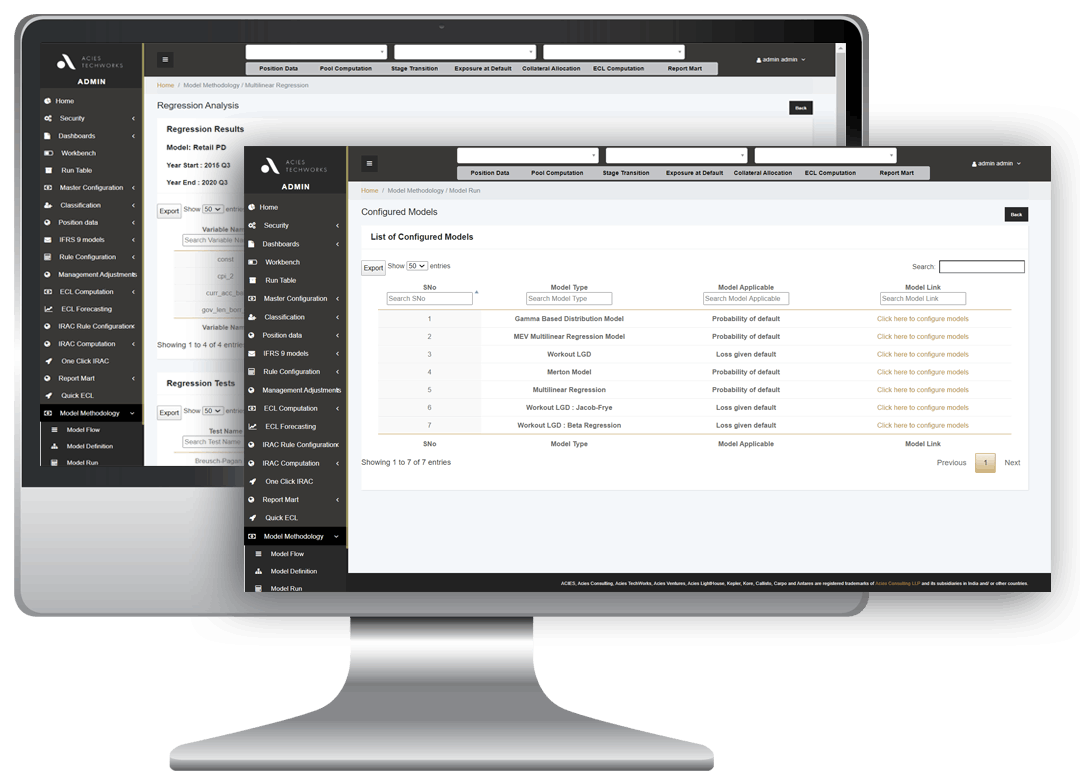

Pre-built and configurable SPPI and business model tests covering all treasury and banking book products

Select from multiple EIR computation and fee amortization methodologies

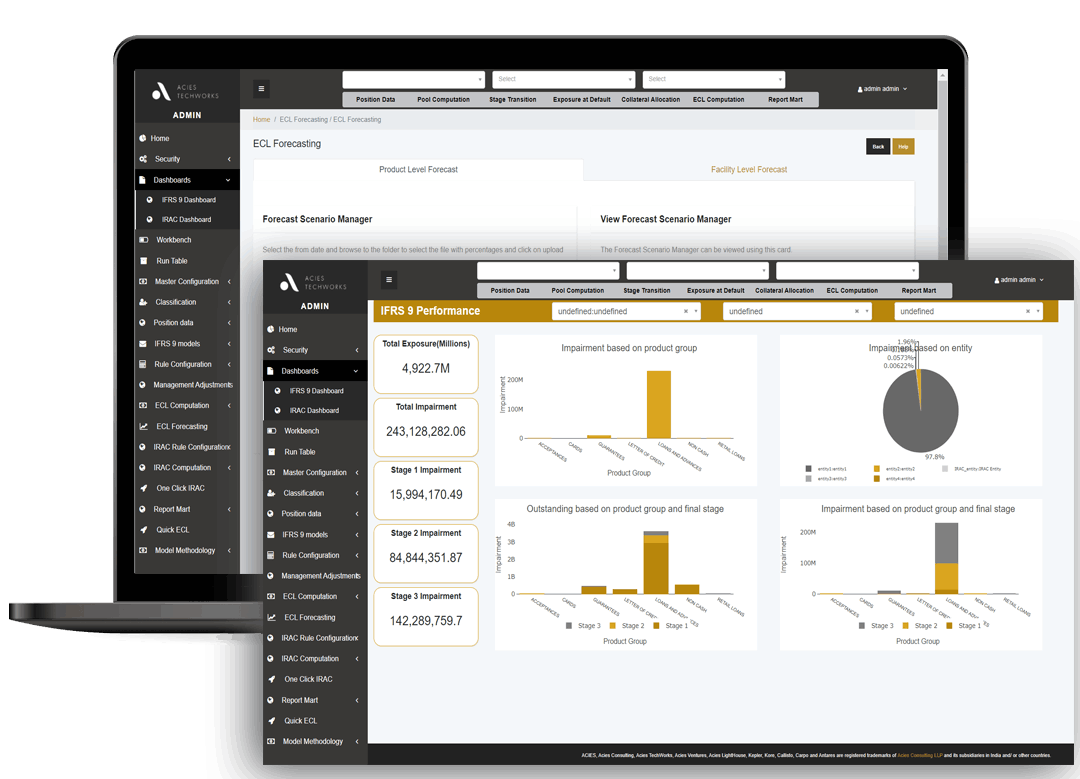

Configurable stage transition rules to support multi-jurisdictional and product specific modalities

Configurable and pre-built stage curing rules

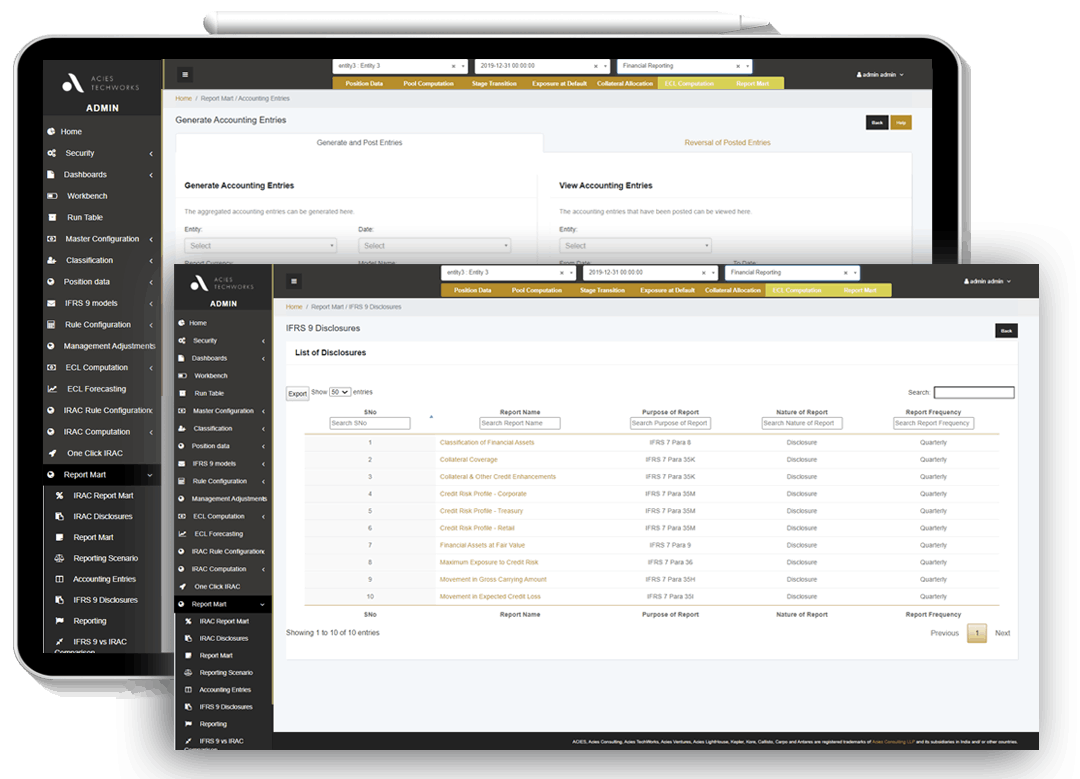

Generate reports and disclosures for any given date, product, portfolio, entity or group

Generate ECL and EIR entries for in consolidation format necessary

Pre-configured financial statement disclosures at the click of a button

Pre-built regulatory reports for multiple juridisctions