A Single Platform for all Customer Categories

Advanced Analytics for Business Decision-Making

Meeting Accounting and Provisioning Terms

Connect with Internal & Third-Party Databases to Obtain Accurate Results

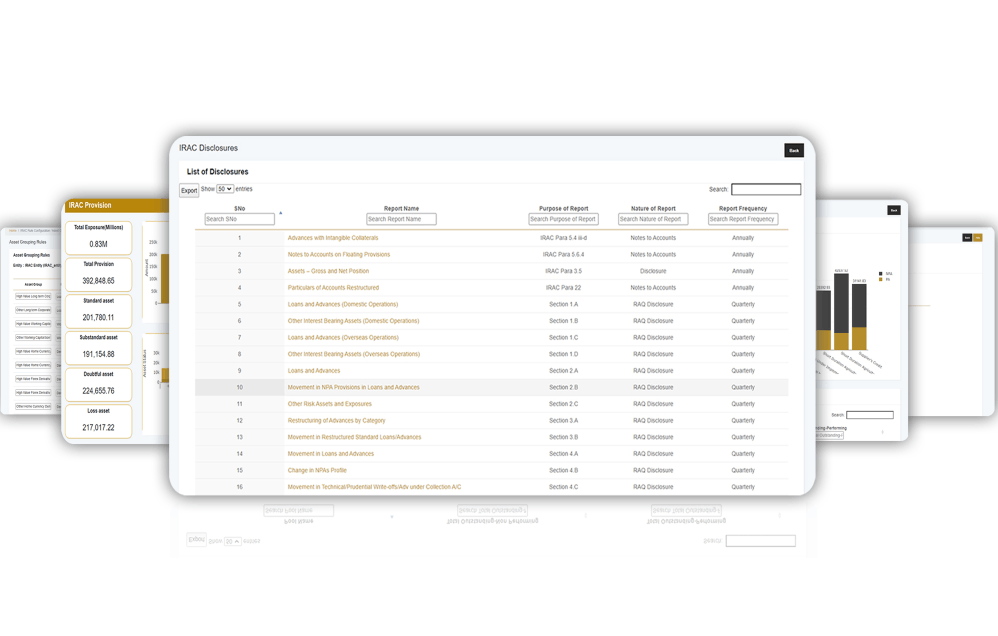

Pre-built and up to date financial and regulatory provisions

Financial

Management

Operational

Legal

External

Collateral